The Ultimate Guide To Amur Capital Management Corporation

As a practical issue, conserving is putting cash apart today for future usage. In economic terms, it's called 'forgone consumption.' To put it another method, you conserve some of your cash instead of investing all of it. Wealth and monetary stability can only be built with investment. A clever financial investment can enhance your cash's worth and surpass inflation.

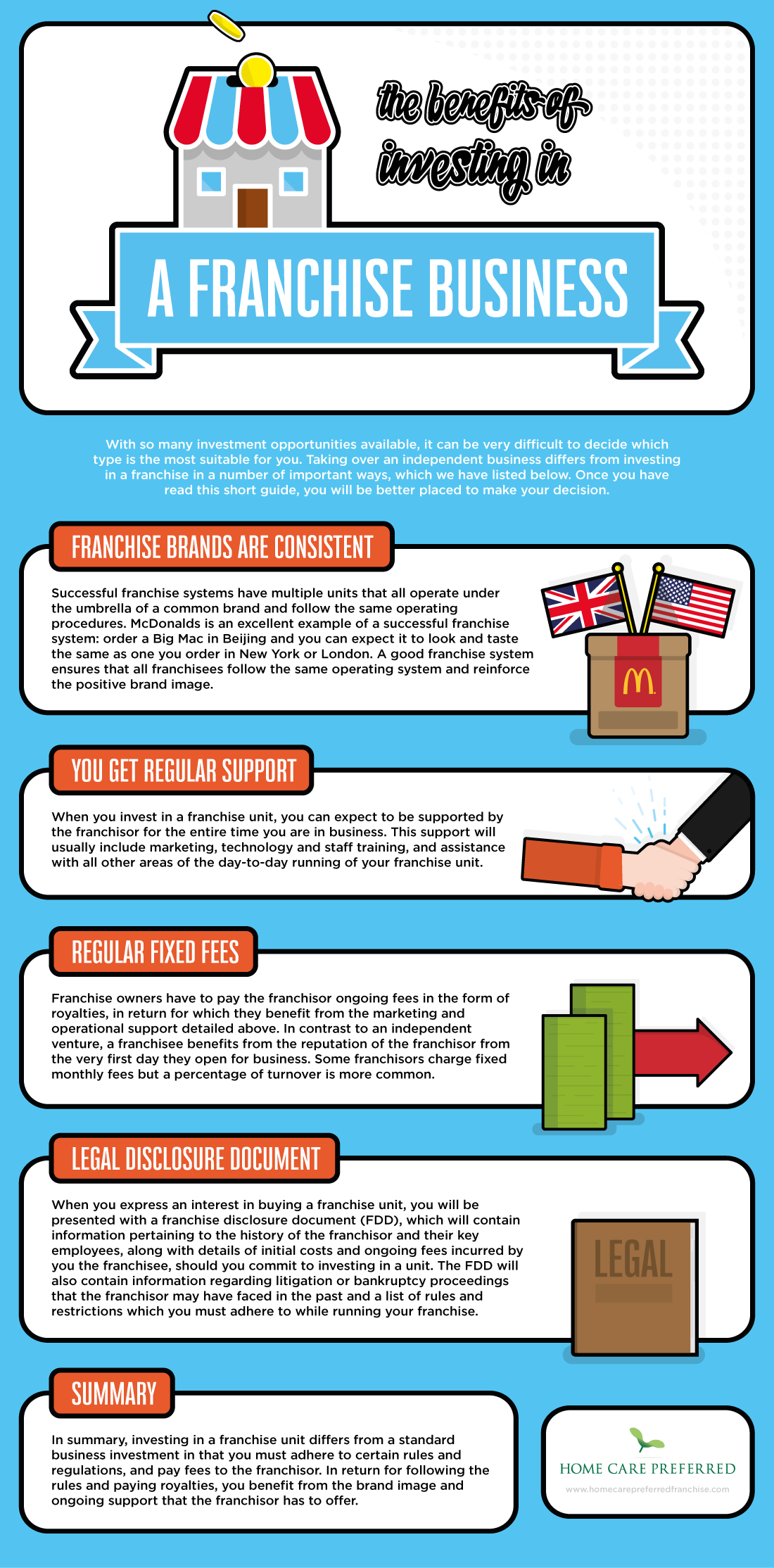

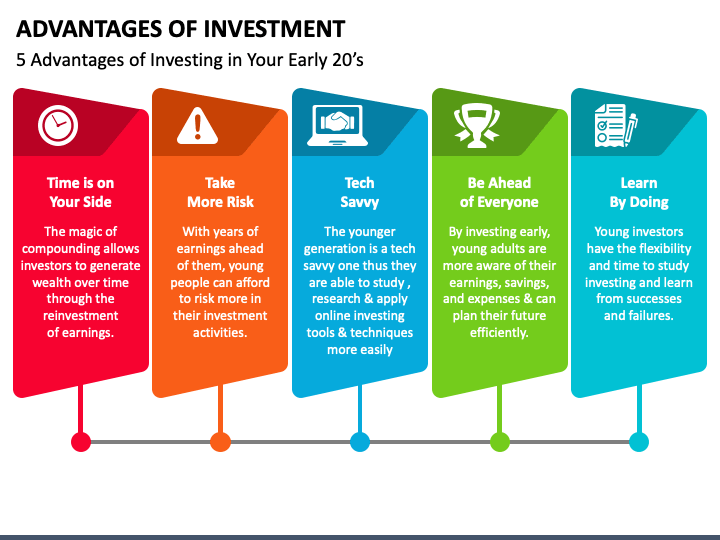

A lifetime of benefits awaits you when you spend, so there is no factor not to take the plunge. Investing has higher development possibility because of worsening and the risk-return compromise. Of all, why should you invest rather of merely saving cash?

Below are a few pros of investing: Investing in top quality financial investments can gain you added income. You may be able to use your return on financial investments as an added resource of income on a normal basis.

Amur Capital Management Corporation for Dummies

The development of your money will certainly be achieved by investing it. You can expect to make returns on your money, such as supply, certificate of deposit, or bond financial investments, if you invest for a lengthy time.

Without spending and growing your cash, you'll in fact shed money with time. Rising cost of living is accountable for every one of this. Prices enhance each year due to inflation, and your cash sheds its buying power consequently. Over the previous couple of years, rising cost of living has averaged around 3%, although the rate can vary extensively.

Not known Incorrect Statements About Amur Capital Management Corporation

As incomes obtain fatter, customer need increases, resulting in greater earnings for companies. By comprehending the four phases of the organization cycle growth, height, tightening, and trough one can better comprehend exactly how the economy works. When it pertains to investing, an usual issue amongst people is the risk of losing their cash.

4 Simple Techniques For Amur Capital Management Corporation

It is likewise really helpful to spend because this can conserve you on taxes! Money invested in a 401k, SEP IRA, or Conventional IRA will not be taxed in the year it is earned.

If you 'd rather pay taxes now, you can select to utilize a ROTH IRA. This option lets you pay taxes now and avoid paying tax obligations later on (investing for beginners in canada).

All About Amur Capital Management Corporation

Various trading approaches must be thought about before clearing up on an investment. This can be advantageous to capitalists that spend in supplies.

Stock investing has both benefits and drawbacks. There are a great deal of Stock financial investments have actually traditionally generated substantial returns over the lengthy term, but they likewise include considerable threats. It is feasible to expand the threats connected with stock investing is possible by purchasing different stocks, sectors, and geographies.

uses a varied and consistent profile of property possessions. Have A Look At Saint Financial investment's cost-free resources today! President of Saint Financial Investment Team Nic is a 2 years seasoned professional in investing and resources raising, concentrating on Real Estate and financial debt markets. With Saint Investment Group, he leads large-scale distressed possession purchases and cutting-edge submissions for investors.

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

The value of financial special info investments and any kind of income is not ensured and can go down as well as up and might be influenced by exchange rate variations - https://www.domestika.org/en/amurcapitalmc. This means that a financier may not get back the quantity invested.

Financiers should talk to their very own expert advisors for recommendations on any kind of financial investment, legal, tax, or accounting problems associating with a financial investment with Columbia Threadneedle Investments. The reference of any kind of specific shares or bonds ought to not be taken as a referral to deal - capital management. Columbia Threadneedle Investments does not provide any type of investment guidance

The analysis consisted of in this record has actually been generated by Columbia Threadneedle Investments for its own investment monitoring activities, might have been acted upon before magazine and is made available right here incidentally. Any type of opinions revealed are made as at the date of publication however undergo transform without notification and must not be viewed as investment recommendations.

About Amur Capital Management Corporation

None of Columbia Threadneedle Investments, its supervisors, policemans or workers make any type of depiction, service warranty, guaranty, or other guarantee that any one of these progressive declarations will confirm to be precise. Info acquired from exterior sources is believed to be reliable, yet its accuracy or completeness can not be ensured. Provided by Threadneedle Possession Administration Limited.

:max_bytes(150000):strip_icc()/understanding-and-preventing-financial-stress-3144546_final1-6d778f5604df4e3fa8fcb6831c6b72fd.png)